- The Markup

- Posts

- Models, Money, & Megarockets

Models, Money, & Megarockets

LFG Ventures presents a weekly newsletter delivering private market (pre-IPO) insights and signals across tech and frontier industries.

Welcome back,

This week’s Markup focuses on what is actually driving momentum right now across private markets and frontier tech. We cover Anthropic’s continued capital momentum, xAI’s massive Series E, OpenAI’s push into health and voice, activity in prediction markets, and another meaningful milestone for SpaceX as Starship continues to come together. A common theme runs through all of it. These are no longer questions of if these companies win, but how access gets priced as they scale.

Let’s go!

📡 Radar

💰 xAI Scales with Massive Funding Round

Elon Musk’s xAI has closed an upsized $20 billion Series E round, topping its original target and signaling major investor confidence in its long-term vision. The capital will accelerate development of Grok models, expand compute infrastructure, and support new AI products, with strategic backing from firms like Nvidia and Fidelity. Coming off rapid growth in compute capacity and a large user footprint, this funding strengthens xAI’s ability to compete with the biggest AI builders. It’s a powerful vote of confidence in the infrastructure and long-horizon strategy we’re backing. Reuters

💪 Anthropic Arms Race

Anthropic is reportedly in talks to raise around $10 billion at a ~$350 billion valuation, highlighting just how central Claude-family models have become to enterprise AI infrastructure. Strong cloud partnerships and deep integrations continue to attract meaningful capital as demand for scalable AI alternatives grows. As investors from Anthropic’s 2024 $18B round, we’re excited about the momentum, and those who joined us should be too. Techcrunch

🧠 OpenAI Enters Daily Life

OpenAI rolled out ChatGPT Health, allowing users to securely connect medical records and wellness apps to get more personalized, context-aware insights, all while keeping health data private and separate. At the same time, reports suggest OpenAI is preparing to launch a new audio-optimized model in Q1, enabling more natural, voice-first interactions. Together, these moves signal a shift beyond text-based AI toward tools that fit seamlessly into daily life. OpenAI is clearly building toward an ambient, always-available assistant that feels less like software and more like infrastructure. OpenAI / Silicon Angle

📊 Kalshi Rolls Out Platinum Tier

Kalshi has unveiled a new “Platinum” VIP program for its most active prediction market users, offering perks like referral incentives, merch, and priority support. This is a clear push to deepen engagement and liquidity on the platform by rewarding high-volume participants, aligning Kalshi with loyalty structures used in financial and trading ecosystems. Yahoo Finance

🚀 SpaceX Stacks Super Heavy

SpaceX just stacked the massive Super Heavy booster ahead of Starship’s 12th test flight, another meaningful step in the rapid build-test-iterate cycle that defines the program. The booster will fly with a taller, upgraded Starship and next-gen Raptor 3 engines as SpaceX pushes toward higher-performance and orbital-class missions. With a launch targeted for Q1 2026, the pace remains aggressive. It’s shaping up to be a big year for SpaceX, and Starship’s momentum continues to reinforce the company’s long-term path toward fully reusable heavy lift and deep-space capability. Space

💬 Prompt

What can I help you with?

Everyone has old family photos that have seen better days. Faded edges, scratches, maybe even a little water damage. Let’s bring it back to life.

____________________________

Restore and colorize this photo realistically. Gently improve clarity, contrast, and sharpness while preserving the original faces, expressions, proportions, and composition exactly as they are. Do not alter or reconstruct facial features. Reduce scratches, haze, and minor noise while keeping natural film grain. Do not add, remove, or invent any background details.

🎯 Content

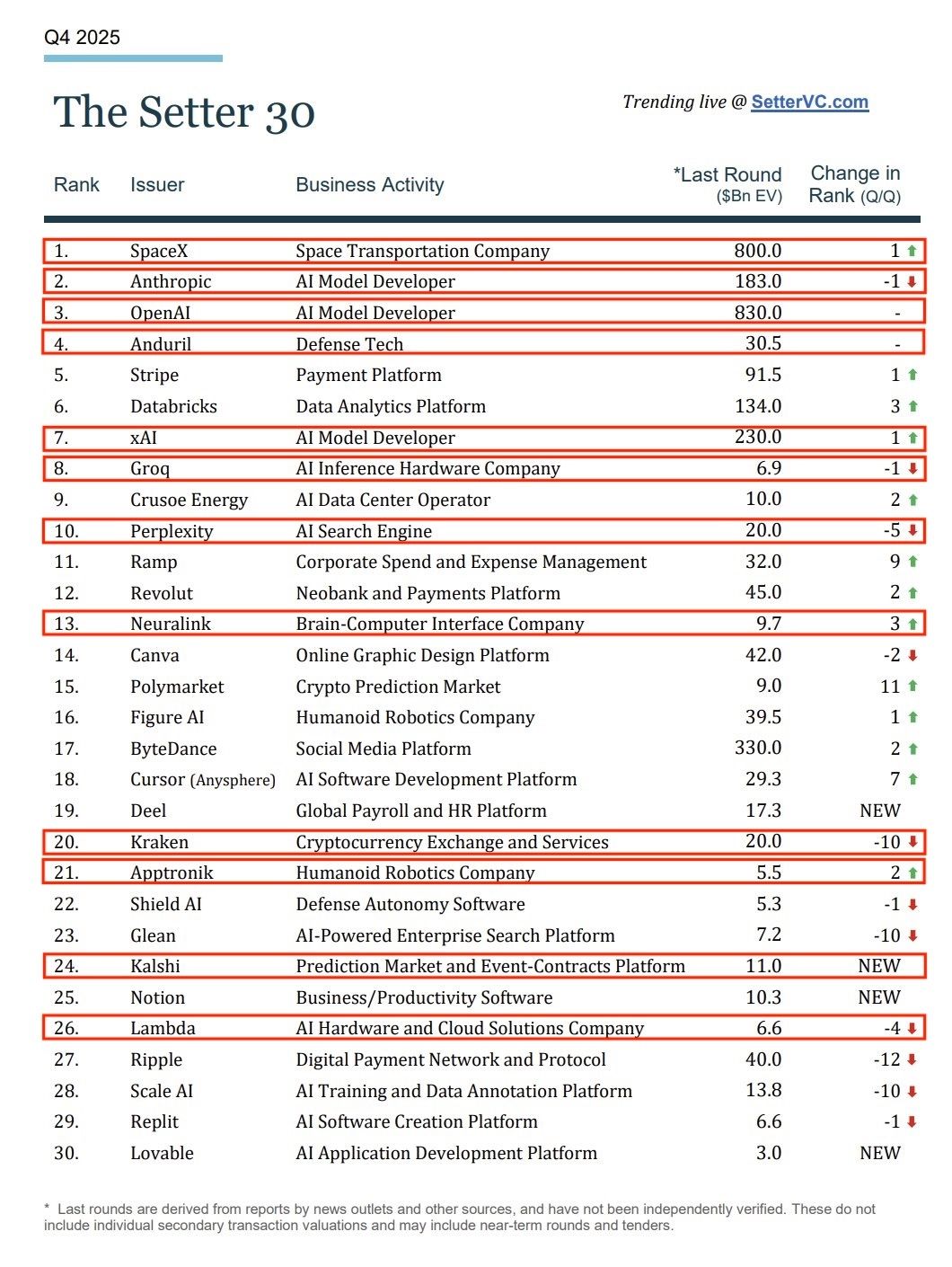

📊 Secondary Leaderboard

Setter just dropped a list of the most in-demand private company shares, and it’s pretty great to see how many of these names we (and many of you) already own alongside us. Almost everything near the top feels less like a bet and more like a question of timing. SpaceX, OpenAI, Anthropic, Anduril, Stripe, Databricks, xAI. These aren’t “will they win” companies, they’re “how expensive is access right now” companies. We’ll be adding to this list throughout the year and plan to share at least two deals a month with the group.

🧠 Brain Hacks

We’re big fans of the Core Memory podcast with Ashlee Vance. He consistently brings on fascinating people with unconventional paths, and we almost always walk away with a few new ideas. In this episode, Ashlee sits down with Andrew Hsu, founder of Speak.ai. The most compelling part of the conversation is Andrew’s belief that learning doesn’t have to be slow and that with the right tools, people can progress orders of magnitude faster. He doesn’t see his own accelerated journey as an outlier, but as a glimpse of what becomes possible when AI takes over the hardest parts of teaching. In that world, technology doesn’t just level the playing field, it compresses time.

🦸♂️ Superpowers in Your Control

-Farnam Street Blog

👕 Gear

We’ve got some new gear coming soon, but a few of our classics are still in stock. Fair warning: this hat gets comments every time you wear it.

🤝 Get in the Room

Private investing for (almost) everyone*

We are a curated network of exceptional angels, VCs, family offices, founders, and industry experts investing in pre-IPO companies. We back sharp operators and high-leverage deals. We move fast. We bring value. We don’t miss around the edges. Deals don’t wait. Neither do we.

*Vibes and values must be aligned. Must be an "accredited investor."

Accelerate.

© 2025 LFG Ventures

All rights reserved.

The content presented in The Markup is for informational purposes only and does not constitute an offer or solicitation by LFG Ventures to buy or sell any securities. Nothing in this publication should be interpreted as investment advice, a recommendation, or an offer to provide brokerage services. Any offers or solicitations will be made only through official offering documents and subject to their specific terms, risks, and conditions.